Research by MICKE

Author: micke

- 293.50 +37.41% (06/11/2025)

- 245.00 +14.70% (02/09/2024)

- BUY

The bank is making good profits. EPS2023=30SEK, up from EPS2022=19SEK. Net income was down in 2022Q4 compared to Q3. Operating income for 2023Q4 was up, but costs and tax where up more vs 2023Q3. Interest rates will probably be declining during 2024, which should lower NII but some growth and higher mortgage margins could give some relief. My high level guess is EPS2024=28SEK, slightly lower than EPS2023. Dividend for 2023 (~50% of EPS) to will be 15,5 SEK, which is 7% (share price 214SEK). If/When US investigations are ended there is a risk of high fines, but probably they will be reasonable, and dividend percentage can go back to 70%. I assume share price will increase when this is finalized, which together with dividend, are my main reasons for owning Swedbank shares.

Business (3)

The large banks in Sweden have a very strong position and everyone in Sweden in reality needs to have an account with one of them, niche players don't offer all services customers need. Many have additional banking for special needs such as stock investments, mortgage and/or high interest accounts depending on current market conditions. Quite many think it is convenient to only have one bank, and not move around savings to optimize interest rates, which is one of the reasons the large banks can make significant profits. All the big banks try to make good return on equity, Swedbank is aiming at ROE=15% (2023 18.3%).

30/01/2024 by MICKE|1Competition from niche players moving from mortgage to deposits

The higher interest rates on savings accounts and cost of bonds for banks on the capital market will also make it very hard for smaller banks without low interest accounts, i.e. salary accounts etc to compete with cheap mortgage. Competition from niche players will increase on high yielding deposit accounts.

30/01/2024 by MICKE|1Baltic scandal

There is a big uncertainty around potential fines from USA related to the Baltic scandal. If this gets finalized at reasonably low levels this will be positive for the share price.

23/10/2023 by MICKE|2

Financial (2)

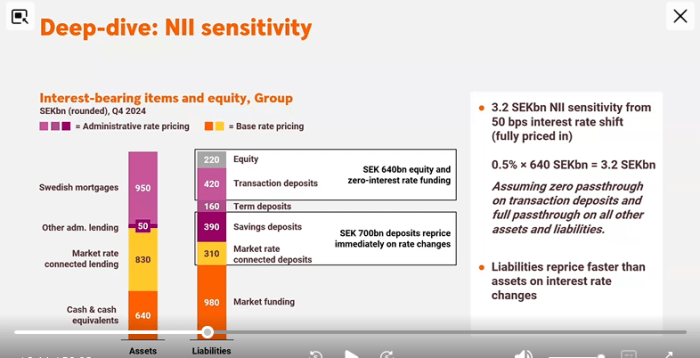

NII-sensitivity. When interest rates drop 0.5% the bank calculates that profite will drop 3.2 SEKbn/year.

24/01/2025 by MICKE|1

24/01/2025 by MICKE|1The bank seems to be making stable profits going forward. Income for 2023Q4 was up, but costs and tax where up more vs 2023Q3, EPS2023=30SEK up from EPS2022=19SEK. Interest rates will probably be declining during 2024, which should lower NII but some growth and higher mortgage margins could balance this. My high level guess is EPS2024=28SEK, slightly lower than EPS2023.

30/01/2024 by MICKE|1

Risks (1)

There are apparent risks with Swedbank, related to the Baltic scandal. But since this is known I think it is reflected in the price. Since there has been quite a lot of issues many larger investors/institutions will not invest in Swedbank.

19/09/2023 by MICKE|1