Research by MICKE

Author: micke

- 32.40 -10.99% (07/11/2025)

- 40.00 +9.89% (07/08/2026)

- HOLD (BUY)

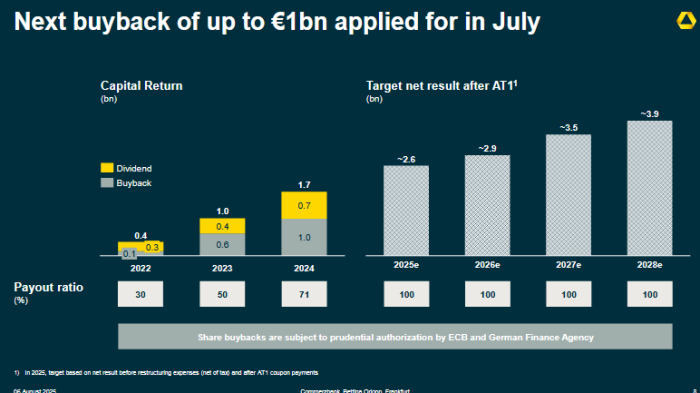

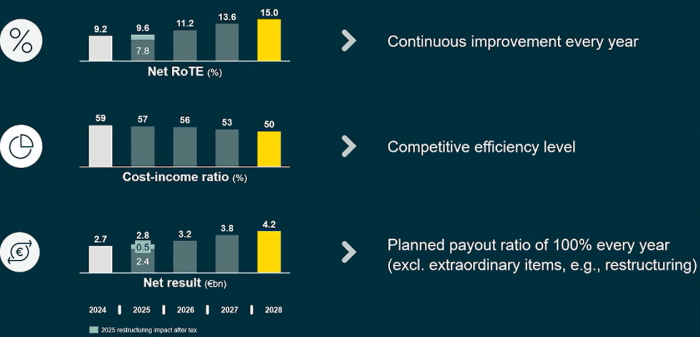

Commerzbank continues to deliver and repeat their plans to increase profits. I think Commerzbank’s result estimates are reasonable, looking back a few years their estimates have been conservative. Long term I think banks that are well run, such as Commerzbank, should be traded at P/E=10 or a bit higher on long term profits and a positive profit trend. The outlook for 2025 was confirmed an slightly raised after 25Q2, Net result ~€2.5bn – respectively ~€2.9bn before restructuring charges. For FY2025 there will be lower costs for CHF loans in PL, I guess ~500M, and no significant costs after FY2025. Commerzbank has a positive outlook with a 2028 plan with yearly growth and cost efficiencies. With these numbers I see that the share price should be around €35 during 2026 and a potential to reach €40 in a couple of years. Short term the share price can be volatility, for example Uni-Credits interest in Commerzbank or not. Commerzbank will be returning (buy back and dividend) ~100% of profits before restructuring costs for FY2025 and following years. In July Commerzbank applied for further €1bn in share buy backs, and higher interest in EU stock market vs US which will probably drive the share price higher during 2025 and there could be a peak for the share in 2025H2 with extra high share price.

Valuation (3)

Commerzbank has a positive profit outlook with 100% return policy for FY2025->FY2028. They have now applied for further buybacks of €1bn, I don't see that there are many shareholders that want to sell which will drive the share price higher.

07/08/2025 by MICKE|1

07/08/2025 by MICKE|1Potential drivers for higher valuation

The banks has ambitions plans to improve profitability. They have good track record of improvement, it is becoming a stable (potentially growing) high dividend company.

Resolution of issues and still significant costs relating to Swiss franc loans in mBank should be ended in 2025.Presentation February 2025

20/02/2025 by MICKE|1

20/02/2025 by MICKE|12024Q4 report, outlook:

"Strategy “Momentum”: significant increase in financial targets until 2028

With its upgraded strategy “Momentum”, Commerzbank has set significantly more ambitious targets than

before. The RoTE is expected to improve to 15% by 2028. This means that the Bank will earn significantly more than its cost of capital and be a well-established player amongst the successful banks in Europe. It is aiming to increase its net result to €4.2 bn by 2028. With only a moderate rise in costs, revenues are expected to increase significantly: The Bank anticipates a compound annual growth rate (CAGR) of 4% excluding provisions for legal risks for FX loans at mBank to €14.2 bn by 2028. The main driver will be net commission income, while a moderate increase in net interest income is expected despite ongoing interest rate cuts. The Bank plans to continue to significantly improve its cost-income ratio to around 50% – an internationally competitive level."My general view is P/E should be around 10 for a well managed EU bank. Current (2025-02-15) market cap is 23.2bn. (4.2*10)/23.2=1.8 i.e. a share price of 19.6*1.8=35 euro (+81%) at the end of 2028. In addition to this we will get dividend and buy backs, i.e. > 100% return in less than 5 years.

15/02/2025 by MICKE|1

People (1)

The CEO Betina Orlopp (former CFO) gives a very good impression and have been able to deliver on restructuring plan. CFO first report was 2024Q4.

15/02/2025 by MICKE|1

Financial (3)

Capital return

2022: 30% (€0.4bn),2023: 50% (~€0.9bn), in 2024Q1 the bank will probably do buybacks of €0.6bn which was slightly higher than initially planned. At share price €10.6 that would obe 4.6% of the shares.

2024: 70 + X%, 2024 return consists of share buy-back applied for after H1 2024 results and dividend approved at AGM in 2025.

2022-24 total: ~€3bn. Where of 3-1.3 = €1.7bn remaining for 2024, €0.6bn in dividend (€0.7/share) and €1bn in buy back.

2025-2027 >90%, but not more than the net result, with the exception of 2025 where it is planned to be 100% excluding restructuring costs. The taget CET1 ratio is 13.5% which is lower than the 15.1% in 2024Q4.

15/02/2025 by MICKE|2Indications 14 March 2024 Morgan Stanley European Financials Conference,

Bertina CFO mentioned that the first 2 months 2024 started very well. I interpret that as NII is on a good level, probably the same level as 2023, while cost an other income are better than 2023Q4. Bertina said that Q1 is normally a good quarter.

https://cc.webcasts.com/morg007/031224a_js/?entity=12_OG0QWG0,16/04/2024 by MICKE|1Finances have improved very significantly due to the new managements execution of a restructuring plan. During 2021 the banks goals as well as analysts' estimates where set for operational profit 2021 (net -500MEUR), net profit 2022=500MEur, 2023=1000MEur, and 2024=1500MEur. With increases in ECB’s rates and good execution the outcome and expectations are now higher.

04/10/2023 by MICKE|2

Risks (2)

As with all banks there are risks for additional taxes, regulations and legal risks relating to potential wrongdoings in this heavily regulated industry.

29/09/2023 by MICKE|1Swiss franc loans in Polish mBank is a risk, was previously a high risk, but with recent court rulings the cost are high but the risk for unexpected result is lower. There is a path forward and significant parts of the problem loans are now resolved. But there are still risks for additional costs and other legal problems related to this.

29/09/2023 by MICKE|1