Research by ALPHA

Author: Alpha

- 68.70 +68.59% (06/11/2025)

- 52.00 +27.61% (07/07/2025)

- BUY

Norion is a niche bank focused on real-estate financing (50%) and SME (19%). As a niche player in the financial sector the company has better growth opportunities. The bank operates in segments with higher risks and higher margins. When well-managed this results in higher profit margins.

The share is valued at <7x PE 2023 with >15% ROE. The company is undervalued at 0.5 PEG and is an attractive value investment (compared to the larger banks).

Valuation (2)

Attractive 0.5 PEG

The attractive <7x PE related to the earnings per share growth ratio provides a good margin-of-safety. The >15% ROE keeps adding to the equity capital, and drives future earnings per share higher. In theory the share has a 100% upside potential when the PE multiple matches earnings per share growth.

The historical conservative valuation of niche banks, with higher risks, is expected to limit the multiple expansion to 8x PE in the short term. In the mid- to longer-term the growth should drive both earnings per share and multiple expansion.

Norion's valuation is pressed due to exposure to Oscar Properties.

14/12/2024 by ALPHA|1Dividend policy

The bank does currently not pay dividends. This could potentially change in case of surplus capital. As long as the company has good growth opportunities, using capital for growth is a better allocation.

Bank's policy is to distribute potential surplus capital in relation to the capital adequacy target, subject to the bank’s future outlook and capital planning, to its shareholders.

20/09/2024 by ALPHA|1

Business (4)

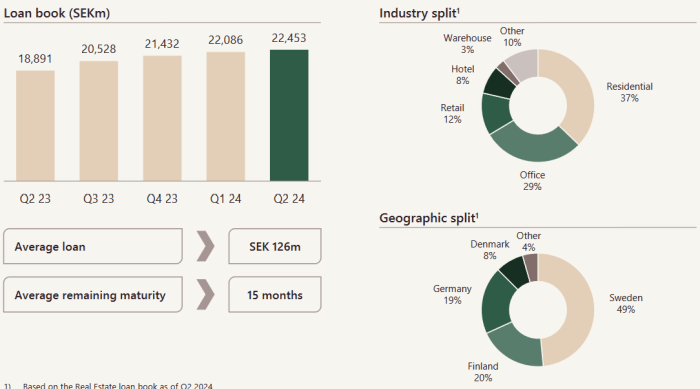

Real-estate

Norion bank real-estate primary and secondary financing.

18/09/2024 by ALPHA|1

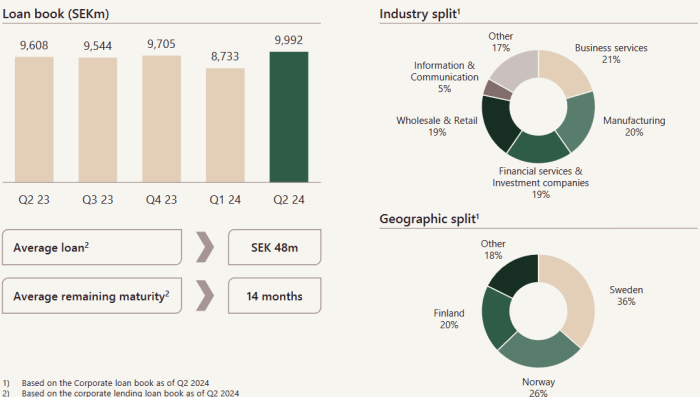

18/09/2024 by ALPHA|1Corporate

Norion bank offers credit solutions to SME.

18/09/2024 by ALPHA|1

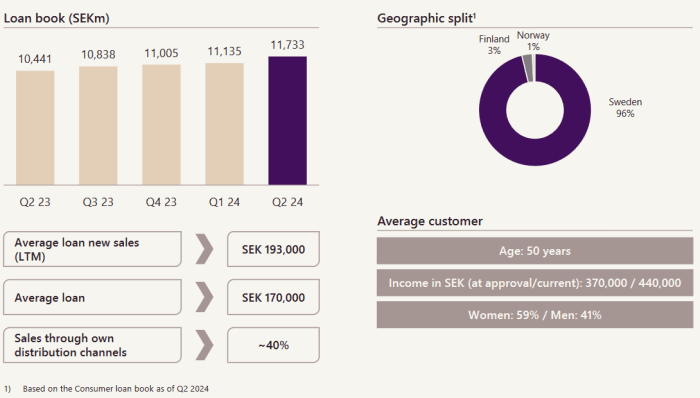

18/09/2024 by ALPHA|1Collector

Collector offers personal loans and credit cards to consumers.

18/09/2024 by ALPHA|1

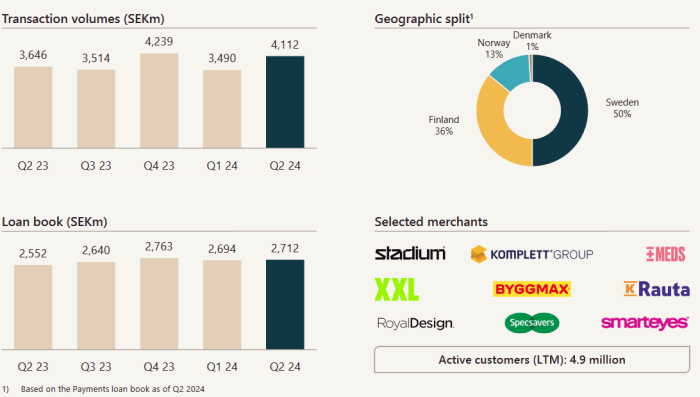

18/09/2024 by ALPHA|1Walley

Walley offers payment and check-out for e-Commerce.

18/09/2024 by ALPHA|1

18/09/2024 by ALPHA|1

People (1)

EriK Selin

Strategic shareholder with excellent track record and expertise in the real-estate market.

18/09/2024 by ALPHA|1

Risks (2)

Economic downturn

The Swedish and global economy show signs for a possible recession. Norion operates in segments with in general higher risks.

In 2020 Collector issued 1Bkr new shares, that caused 50% dilution, to strengthen its balance sheet during the COVID crisis.

In 2022-2023 rising interest rates triggered a downturn in the real-estate market and increased defaults in SME. Management has navigated these changed market conditions well.

28/09/2024 by ALPHA|1Regulatory risks

As a niche bank Norion is more sensitive for regulatory risks and the costs of regulatory changes.

28/09/2024 by ALPHA|1