Research by ALPHA

Author: Alpha

- 271.60 -8.24% (06/11/2025)

- 350.00 +18.24% (30/10/2026)

- BUY

Bioarctic is a Biotechnology research company with commercial approved Alzheimer medication LEQEMBI, and treatments for other neurodegenerative diseases. The company is a pioneer and global market leader for Alzheimer treatment.

The LEQEMBI sales are expected to turn BioArctic profitable in 2025. The fast growing license revenue complemented with (large) milestone payments result in a strong positive cash-flow. BioArctic is compounding on its technology with a portfolio of project and collaborations. As research company it invests heavily in R&D.

BioArctic is a volatile investment, with volatile earnings due to large milestones, currently valued at 25x PE. I think the share price has the potential to double in the longer term (3-5 years). This is a quality company to invest in that requires some risk tolerance. Major price action triggers can be expected in the short-term from new collaboration agreements, whereas bad news/volatility can create opportunities to increase the position.

Valuation (3)

Long term growth

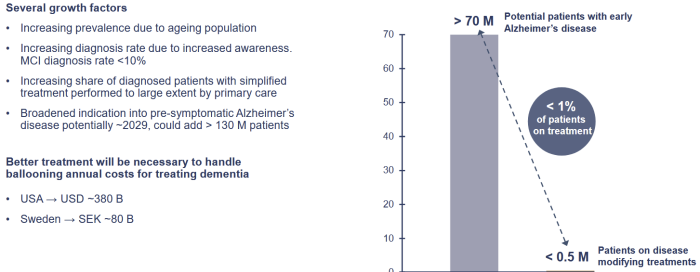

Less than 1% of Alzheimer patients receive treatment which leaves a huge unmet need. There is a huge growth potential in the addressable market that can be unlocked with new diagnose technology like blood market tests and easier treatment options.

03/11/2025 by ALPHA|1

03/11/2025 by ALPHA|1Blood Marker Diagnostics

Developments of diagnostics are progressing with FDA approval of Alzheimer's blood tests measuring proteins like p-tau, the creation of multi-cancer early detection (MCED) blood tests, and advancements in Parkinson's disease blood tests that measure alpha-synuclein in nerve cell vesicles.

Blood-based biomarkers, like p-tau217 and MTBR-tau243, enable cheaper Alzheimer’s diagnosis and earlier detection. This will expand the addressable market and increase demand for medication by a larger patient population during a longer time.

Bioartic benefits from the technical developments, especially with the FDA approved self-administrative Leqembi Iqlik, the company is ahead of competitors.

The technical advancements can move Alzheimer diagnoses and treatment into primary care instead of expensive specialist care, which would significantly increase the addressable market.

31/10/2025 by ALPHA|1Bristol Myers Squibb (BMS)

In December 2024, BioArctic and Bristol Myers Squibb (BMS) entered into a global license agreement valued up to $1.35 billion, plus double-digit royalties, for an Alzheimer's disease program based on BioArctic's proprietary BrainTransporter technology, currently pre-clinical.

The agreement included a $100M upfront payment that was received in 2025.

Let's assume the project can take 10 years; than the agreement adds around $100M (≈1.000Mkr) annual revenue on average with irregular milestones. That revenue will become bottom-line profit, as BioArctic is expected to be profitable on its LEQEMBI license revenue in 2026.

30/10/2025 by ALPHA|1

Business (5)

Price of LEQEMBI (Lecanemab)

The annual cost of LEQEMBI (lecanemab), the Alzheimer's disease treatment co-developed with Eisai and Biogen, is approximately $26,500 per patient per year in the U.S. This pricing reflects the standard dosing schedule administered every two weeks.

Kisunla (donanemab) by Eli Lilly, is set at approximately $32,000 in the United States.

14/11/2025 by ALPHA|1Brain transporter

The BrainTransporter™ is a technology to cross the blood-brain barrier to deliver biotherapeutics to the brain. The blood brain barrier (BBB) controls the passage of substances between the bloodstream and the brain, and protects the brain from harmful substances. At the same time, it makes the delivery of drugs to the brain difficult.

The technology has in preclinical models demonstrated a dramatically improved antibody delivery to the brain. Up to 70-fold increase of amyloid-beta antibody brain exposure, with a rapid, broad and deep distribution of amyloid-beta antibodies across the brain. The results provide preclinical validation of a BrainTransporter-linked antibody, without negative effects on the blood or unwanted immunological reactions.

The BrainTransporter technology helps deliver treatments to the brain in different ways and can be used in a number of different therapy areas, giving BioArctic many potential future partnering opportunities.

On BioArctic's Capital Market day Gunilla Osswald mentioned that short-term priority is to sign more new collaboration agreements.

13/11/2025 by ALPHA|1Neuro degenerative diseases

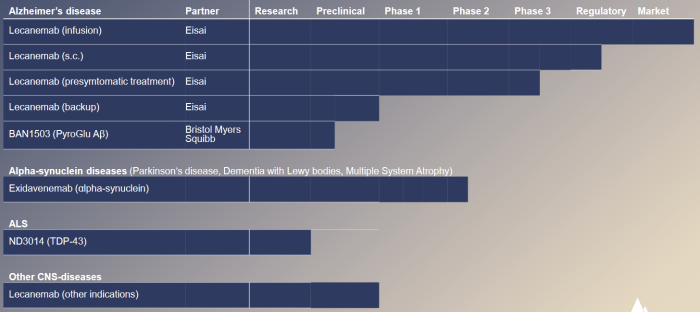

BioArctic has a portfolio of projects for drugs to address Central Nervous System (CNS) disorders like Parkinson and ALS. After the Lecanemab success the company is well positioned for attractive strategic partnerships with global pharmaceutical companies.

02/11/2025 by ALPHA|1

02/11/2025 by ALPHA|1LEQEMBI (lecanemab)

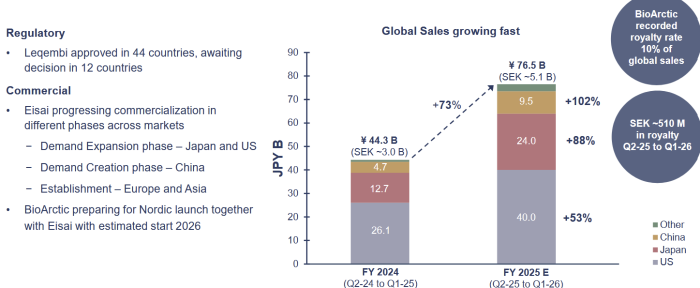

Lecanemab Alzheimer medication is marketed as LEQEMBI through a global partnership with EISAI. The drug is approved in all major markets; US, Japan, China, EU and the UK.

Eisai global Leqembi sales simulation indicated a growth to ¥250B in 2027.

02/11/2025 by ALPHA|1Parkinson

Phase 2 for Parkinson disease drug Exidavnemab is planned to start in 2024. Abbvie ended its partnership with BioArctic in 2022 in favor of its own medication. The FDA has however already twice declined approval of the medication.

It can be expected that BioArctic will seek a new partnership for Parkinson disease. Given the strong cash position the company has time to select the right partner.

02/09/2024 by ALPHA|1

People (1)

People

The people behind BioArctic have the mission to build the next large Scandinavian medical company. With a small team they have realized break-through technology and became global market leader in their field, where other larger companies failed.

BioArctic has a proven successful team, and the resources, to deliver this mission.

See BioArctic's Capital Market day for more background.

30/10/2025 by ALPHA|1

Financial (3)

Financial results & estimates

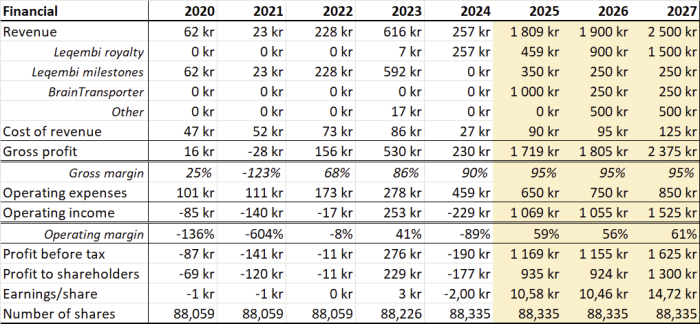

Revenue comes from strong growing LEQEMBI royalties and collaboration milestones. More partnership deals can be expected related to other portfolio drugs. As the company grows the operational costs, including R&D, are increasing.

Going forward earnings per share >10kr can be realized, but this depends on new lucrative partnership deals and realization of ongoing project milestones.

In case Leqembi sales growth stalls and/or there are no new deals the earnings per share will be significant lower, as will be the share price.

04/11/2025 by ALPHA|1Sales results

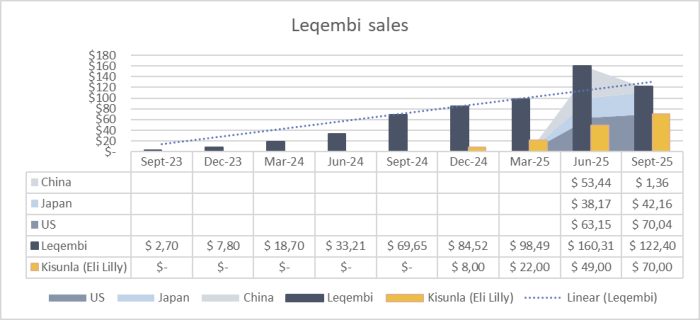

The Leqembi sales are growing on a quarter-by-quarter basis. EISAI Leqembi sales forecast for FY2025 is $520M (ending March 2026). Except for the Q3-2025 sales with a decline of $32M. This can be explained by the $50M sales and stock-piling in China in the previous quarter in reaction to tariffs. Next quarter sales will give more colour on the competition between Leqembi by EISAI, BioGen and Bioarctic vs Kisunla by Eli Lilly. These are catalyst for short-term growth (1-2 years) and valuation.

03/11/2025 by ALPHA|1

03/11/2025 by ALPHA|1Cash balance

Strong cash position of 1.900Mkr in Q2'25. As the company turns profitable the cash-flow is positive and creates the possibility for dividend in 2026/2027.

30/10/2025 by ALPHA|1

Risks (4)

Novo Nordisk

In Q4 2025 Novo Nordisk is expected to present the results of its EVOKE phase III study for the disease-modifying potential of oral semaglutid, in participants with early-stage symptomatic AD, including exploration of effects on AD biomarkers and neuroinflammation.

10/11/2025 by ALPHA|1Eli Lilly's Kisunla

Kisunla (Donanemab) is a competing drug developed by Eli Lilly approved in July 2024. The medical results are similar to LEQEMBI although for some patient groups effects are higher, but also are the bi-effects. It would be a risk when effect proves to be significantly higher without a higher patient risk profile or treatment would be significant cheaper.

Donanemab is more effective in removing amyloid plague, but does not prevent plague. The dual effect of LEQEMBI clears plaque and protofibrils. LEQEMBI has a clinical advantage in that it continuous to clear protofibrils that damage neurons.

BioArctic and Eli Lilly ($800B market-cap) are in tough competition for Alzheimer patients.

04/11/2025 by ALPHA|1Aria

In the clinical trial 12% of patients developed a form of ARIA. Since approval a few patients died due to ARIA during the treatment with LEQEMBI. Its is a risk that patient safety could be insufficient. The risk will be mitigated as treatment practices improve.

03/11/2025 by ALPHA|1Patent expiration

The patent portfolio contains 13 patent families and 240 applications. The Lecanemab patent expires in 2032 although market exclusivity could be up to 12 years (2035). The long-term growth and value depends on wider development of the portfolio to generate revenue later in 2030's.

30/10/2025 by ALPHA|1